Property Tax In Frederick County Md . The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. Finding your property information online. The frederick county treasurer's office, located at 30 n market st, frederick, md, is responsible for collecting recordation tax and offering various. Although frederick county does not offer any type of formal payment plan for customers, they do accept partial payments of. These instructions will help you locate your property information on our real property data system. Claim for refund of tax erroneously paid. Indemnity deed of trust tax law and affidavit. Real estate tax bill inquiry. Assess all the factors that determine a property's taxes with a detailed report like the.

from www.signnow.com

Finding your property information online. Real estate tax bill inquiry. Indemnity deed of trust tax law and affidavit. The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. The frederick county treasurer's office, located at 30 n market st, frederick, md, is responsible for collecting recordation tax and offering various. Assess all the factors that determine a property's taxes with a detailed report like the. Claim for refund of tax erroneously paid. These instructions will help you locate your property information on our real property data system. Although frederick county does not offer any type of formal payment plan for customers, they do accept partial payments of.

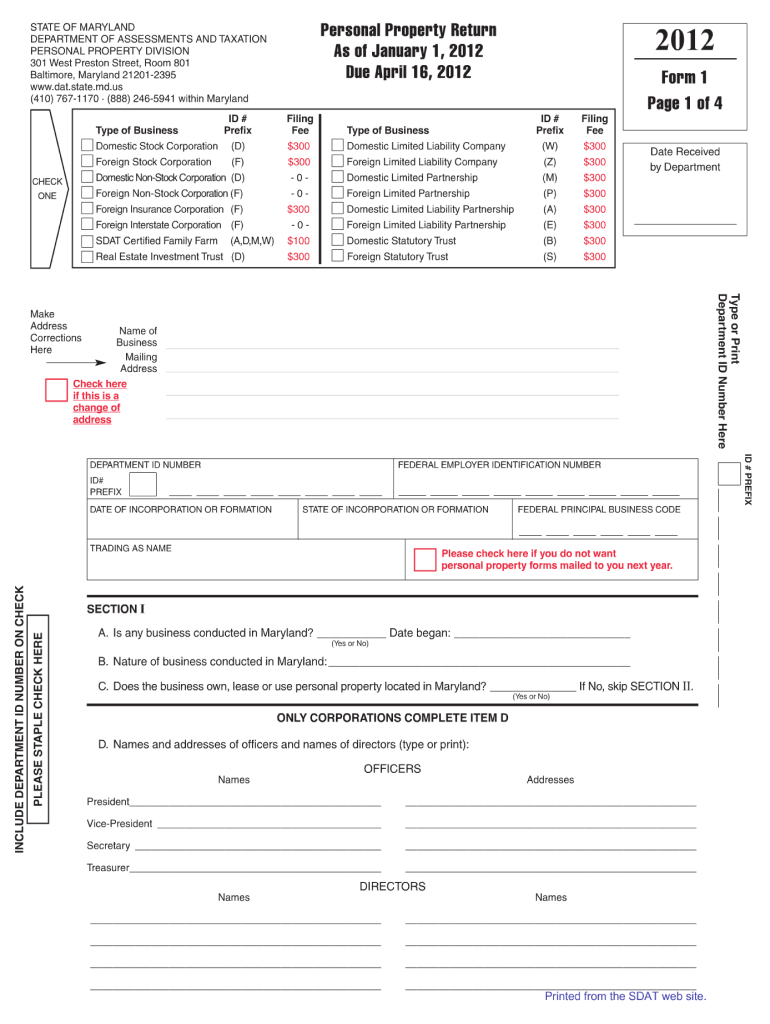

Personal Property Return Maryland Form Fill Out and Sign Printable

Property Tax In Frederick County Md Indemnity deed of trust tax law and affidavit. Assess all the factors that determine a property's taxes with a detailed report like the. Indemnity deed of trust tax law and affidavit. Finding your property information online. These instructions will help you locate your property information on our real property data system. Claim for refund of tax erroneously paid. The frederick county treasurer's office, located at 30 n market st, frederick, md, is responsible for collecting recordation tax and offering various. Real estate tax bill inquiry. Although frederick county does not offer any type of formal payment plan for customers, they do accept partial payments of. The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of.

From www.land.com

6 acres in Frederick County, Maryland Property Tax In Frederick County Md Claim for refund of tax erroneously paid. Real estate tax bill inquiry. Assess all the factors that determine a property's taxes with a detailed report like the. The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. Finding your property information online. The frederick county treasurer's. Property Tax In Frederick County Md.

From mapsforyoufree.blogspot.com

Frederick County Va Tax Map Maping Resources Property Tax In Frederick County Md Finding your property information online. Real estate tax bill inquiry. Assess all the factors that determine a property's taxes with a detailed report like the. Although frederick county does not offer any type of formal payment plan for customers, they do accept partial payments of. These instructions will help you locate your property information on our real property data system.. Property Tax In Frederick County Md.

From www.financestrategists.com

Find the Best Tax Preparation Services in Frederick, MD Property Tax In Frederick County Md The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. Indemnity deed of trust tax law and affidavit. Real estate tax bill inquiry. Although frederick county does not offer any type of formal payment plan for customers, they do accept partial payments of. The frederick county. Property Tax In Frederick County Md.

From editable-form.com

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form Property Tax In Frederick County Md Indemnity deed of trust tax law and affidavit. The frederick county treasurer's office, located at 30 n market st, frederick, md, is responsible for collecting recordation tax and offering various. These instructions will help you locate your property information on our real property data system. Assess all the factors that determine a property's taxes with a detailed report like the.. Property Tax In Frederick County Md.

From www.landwatch.com

Frederick, Frederick County, MD House for sale Property ID 336705289 Property Tax In Frederick County Md Claim for refund of tax erroneously paid. The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. The frederick county treasurer's office, located at 30 n market st, frederick, md, is responsible for collecting recordation tax and offering various. These instructions will help you locate your. Property Tax In Frederick County Md.

From www.landwatch.com

Frederick, Frederick County, MD House for sale Property ID 336318120 Property Tax In Frederick County Md The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. Indemnity deed of trust tax law and affidavit. Real estate tax bill inquiry. Assess all the factors that determine a property's taxes with a detailed report like the. Although frederick county does not offer any type. Property Tax In Frederick County Md.

From devinqlaurella.pages.dev

Maryland Tax Brackets 2024 Carry Crystal Property Tax In Frederick County Md Assess all the factors that determine a property's taxes with a detailed report like the. Claim for refund of tax erroneously paid. These instructions will help you locate your property information on our real property data system. The frederick county treasurer's office, located at 30 n market st, frederick, md, is responsible for collecting recordation tax and offering various. Indemnity. Property Tax In Frederick County Md.

From www.pinterest.com

Frederick County, Maryland, Middletown, Maryland. Road Routes, South Property Tax In Frederick County Md Assess all the factors that determine a property's taxes with a detailed report like the. These instructions will help you locate your property information on our real property data system. The frederick county treasurer's office, located at 30 n market st, frederick, md, is responsible for collecting recordation tax and offering various. Real estate tax bill inquiry. Finding your property. Property Tax In Frederick County Md.

From elatedptole.netlify.app

Frederick Md Zip Code Map Map Vector Property Tax In Frederick County Md The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. Assess all the factors that determine a property's taxes with a detailed report like the. Real estate tax bill inquiry. These instructions will help you locate your property information on our real property data system. Although. Property Tax In Frederick County Md.

From www.velocitytitle.com

Maryland Property Taxes—Understanding Assessments and Appeals Property Tax In Frederick County Md The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. Indemnity deed of trust tax law and affidavit. Real estate tax bill inquiry. Assess all the factors that determine a property's taxes with a detailed report like the. These instructions will help you locate your property. Property Tax In Frederick County Md.

From www.landwatch.com

Middletown, Frederick County, MD House for sale Property ID 414545908 Property Tax In Frederick County Md Real estate tax bill inquiry. Assess all the factors that determine a property's taxes with a detailed report like the. These instructions will help you locate your property information on our real property data system. Finding your property information online. Claim for refund of tax erroneously paid. Indemnity deed of trust tax law and affidavit. The median property tax (also. Property Tax In Frederick County Md.

From benfrederick.com

Maryland Property Tax Assessment Notices Ben Frederick Realty Property Tax In Frederick County Md Claim for refund of tax erroneously paid. These instructions will help you locate your property information on our real property data system. Indemnity deed of trust tax law and affidavit. Finding your property information online. Assess all the factors that determine a property's taxes with a detailed report like the. The frederick county treasurer's office, located at 30 n market. Property Tax In Frederick County Md.

From frederickrealestateonline.com

A Comprehensive Guide to Property Taxes in Maryland Frederick Real Property Tax In Frederick County Md Claim for refund of tax erroneously paid. The frederick county treasurer's office, located at 30 n market st, frederick, md, is responsible for collecting recordation tax and offering various. Assess all the factors that determine a property's taxes with a detailed report like the. Finding your property information online. Although frederick county does not offer any type of formal payment. Property Tax In Frederick County Md.

From freepages.rootsweb.com

1749 Western Half 1749 Eastern Half Property Tax In Frederick County Md Indemnity deed of trust tax law and affidavit. These instructions will help you locate your property information on our real property data system. The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. Claim for refund of tax erroneously paid. Finding your property information online. Assess. Property Tax In Frederick County Md.

From frederickrealestateonline.com

Frederick MD Real Estate Taxes Frederick Real Estate Online Property Tax In Frederick County Md The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. Real estate tax bill inquiry. Indemnity deed of trust tax law and affidavit. These instructions will help you locate your property information on our real property data system. Although frederick county does not offer any type. Property Tax In Frederick County Md.

From ocontocountyplatmap.blogspot.com

Frederick County Md Zip Code Map Oconto County Plat Map Property Tax In Frederick County Md Indemnity deed of trust tax law and affidavit. The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. The frederick county treasurer's office, located at 30 n market st, frederick, md, is responsible for collecting recordation tax and offering various. These instructions will help you locate. Property Tax In Frederick County Md.

From www.land.com

0.58 acres in Frederick County, Maryland Property Tax In Frederick County Md Assess all the factors that determine a property's taxes with a detailed report like the. Although frederick county does not offer any type of formal payment plan for customers, they do accept partial payments of. The median property tax (also known as real estate tax) in frederick county is $3,082.00 per year, based on a median home value of. Real. Property Tax In Frederick County Md.

From www.land.com

20 acres in Frederick County, Maryland Property Tax In Frederick County Md Real estate tax bill inquiry. Claim for refund of tax erroneously paid. Although frederick county does not offer any type of formal payment plan for customers, they do accept partial payments of. Assess all the factors that determine a property's taxes with a detailed report like the. The frederick county treasurer's office, located at 30 n market st, frederick, md,. Property Tax In Frederick County Md.